You cannot watch the news these days without realizing that there are some inexorable demographic trends that will change the ways we work, live and handle our money. For example, white males will soon be a minority in the work force (something unthinkable in the days of Mad Men. It would be interesting to see how Don Draper would fare in today’s world.)

You cannot watch the news these days without realizing that there are some inexorable demographic trends that will change the ways we work, live and handle our money. For example, white males will soon be a minority in the work force (something unthinkable in the days of Mad Men. It would be interesting to see how Don Draper would fare in today’s world.)

Boomers – the demographic pig moving toward the tail of the python of time – are now reaching what the government calls normal retirement age. Unbeknownst to the government, normal and retirement are increasingly separate concepts.

The fact is that many Boomers are neither ready for retirement nor do they want to retire. Copious research (including many studies we have conducted for our clients) show that Boomers have not done a great job of asset accumulation and are now struggling with what financial advisors are calling decumulation (better add that to your spell check) aka the money one needs to sustain oneself when salary stops and life/bills go on. This is a relatively new discipline and has spawned at least one association – the Retirement Income Industry Association, which has developed programs to give credentials to advisors specializing in retirement income.

We Googled retirement income and came up with any number of calculators, how-to sites, advisors who can help and prognostications of doom. There is one advisor we heard of who, in the middle of his slide presentation, inserted a picture of cat food and spam as a reminder of what poor planners will be eating in their golden years.

There are many contributing factors to the plight of the Boomers. This generation celebrated youth (“Never trust anyone over thirty”) and created New Values (according to Dan Yankelovich) and the Culture of Narcissism (according to Christopher Lash.) This generation now finds itself standing ill-prepared on the doorstep to retirement.

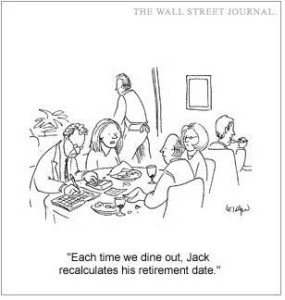

Like Jack in the cartoon, Boomers are figuring out what retirement really means to them, but also what lifestyle (another Boomer contribution) they can afford. So retirement income is what’s happening now. Affluent Boomers are taken care of. They have legions of financial advisors who will manage Boomer assets into their own comfortable retirement. But who holds the key to the Boomer echelons below the affluent? It’s a huge population that needs advice on lots of issues – retirement income being the most immediate.

So here are the tough questions: How can Boomers maximize scarce resources to maintain a decent life style? How can they stretch out their assets? Do they want to leave a legacy to their children and grandchildren and, if so, what do they have to do? How much will they have to work to make ends meet? How much will they want to work to keep fulfilled?

And the tough questions for the financial services industry: Who is going to address these Boomer needs? What will be the business model? Can this population be served profitably? What will be the service model?

Once these questions are answered, here’s the next one. Who is going to step up and win the financial hearts and minds of Gen Xers and Millennials?