Payments Update: Buy Now Pay Later Usage Continues to Grow

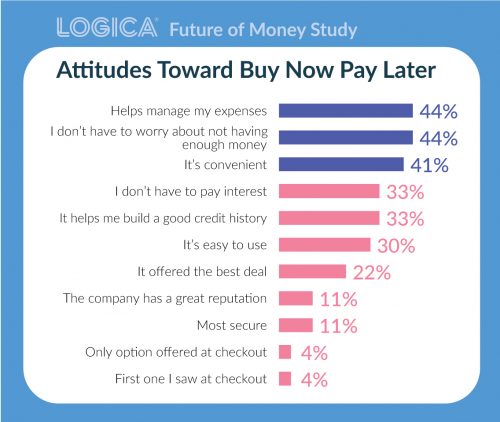

More than ever, people are looking for innovative solutions for how they manage cash flow and expenses. In the latest wave of our Logica® Future of Money Study, we found Americans are looking to Buy Now Pay Later (BNPL) as one solution. Although usage of traditional payment methods isn’t going away, we see growth in the use of financing options or BNPL services to manage expenses (44%) and help alleviate present financial uncertainties (44%).

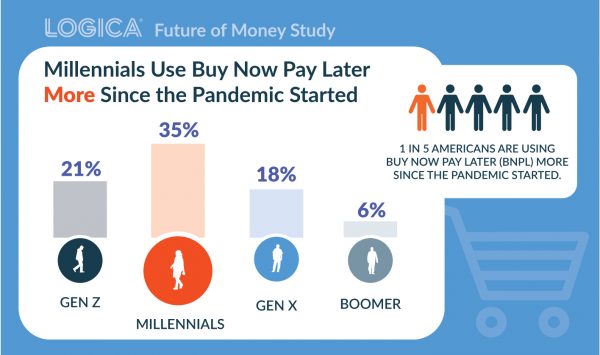

In fact, one in five Americans are using BNPL more since the pandemic started. In our recent webinar, we took a deeper look at the many ways Millennials are different from other generations in the way they handle their finances—and BNPL is no exception. Thirty-five percent of Millennials use BNPL, compared to 21% of Gen Z and 18% of Gen X.

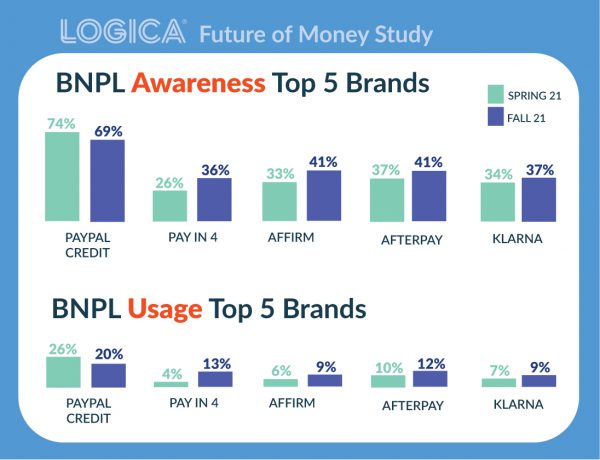

Awareness and usage of BNPL platforms has been growing and shifting as well. Our Logica Future of Money Study shows that while the BNPL service PayPal Credit is the most well-known (69% awareness among Americans), awareness of other platforms is growing like Pay in 4 (13%), Klarna (9%) and Affirm (9%). Below you can see the trends between the Spring 2021 and Fall 2021 waves of our ongoing study.

This latest study not only looked at BNPL when examining the trends in how Americans spend their money. Across the board, we see an increase in digital and mobile payments, as well as peer-to-peer payment options. To learn more about how people spend, as well as trends around making money, investing, and expectations from financial institutions and employers, you can get our highlight report here, or reach out to us to arrange a deep dive into the data.